To set up secure payment gateways for ecommerce, start by choosing a reputable provider that offers robust security features like SSL encryption and fraud protection. Integrate the gateway seamlessly with your website, ensure PCI compliance, and regularly update your security protocols. Utilizing two-factor authentication and monitoring transactions also help safeguard customer data and build trust.

A secure payment gateway is essential for protecting customer information and ensuring smooth transactions. By selecting reliable providers, implementing strong security measures, and staying vigilant against threats, you can create a safe shopping environment that boosts customer confidence and enhances your business reputation.

Getting your ecommerce site ready for secure payments might seem daunting, but it doesn’t have to be. The key is to choose the right payment gateway with proven security features, integrate it properly into your site, and maintain continuous security practices. This approach helps prevent fraud, protects sensitive data, and fosters trust among your customers, ultimately leading to increased sales and long-term success.

How to set up secure payment gateways for ecommerce

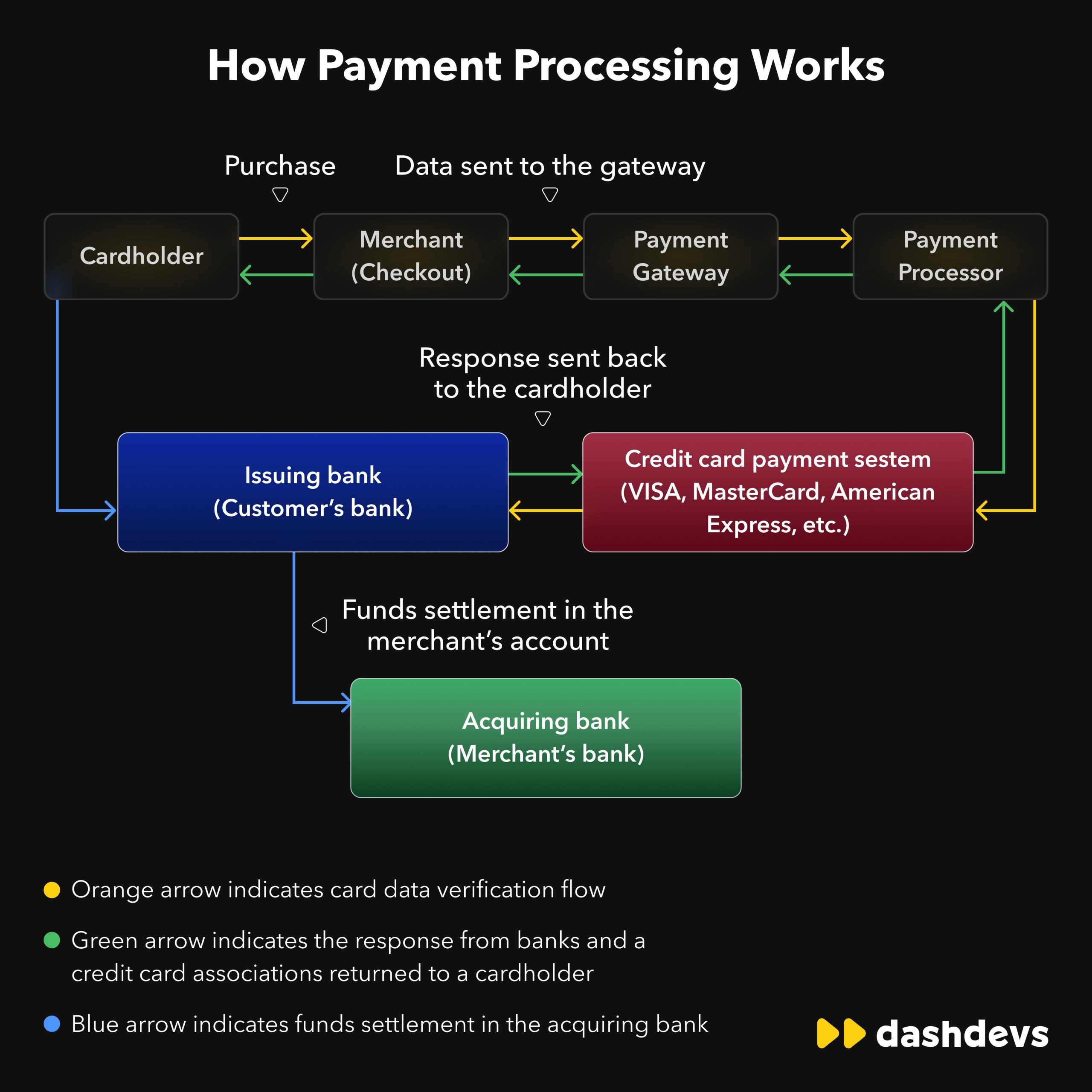

Setting up a secure payment gateway is a vital step in building trust with your customers and protecting their sensitive information. A payment gateway acts as the bridge between your online store and the financial institutions that process payments. Ensuring it is secure helps prevent fraud and boosts customer confidence in your business.

Understanding the Basics of Payment Gateways

A payment gateway securely transmits transaction data from your website to the payment processor. It encrypts sensitive payment details such as credit card numbers, making sure they are safe from hackers. Choosing the right gateway depends on your business size, customer location, and preferred payment methods.

Key Functions of a Payment Gateway

- Encrypts customer payment data for security

- Handles authorization requests to banks

- Transfers funds from customer to merchant account

- Provides transaction receipts and status updates

Steps to Choose the Right Payment Gateway

Assess Your Business Needs

Consider factors like transaction volume, types of payments accepted, and customer preferences. If you sell internationally, ensure the gateway supports multiple currencies and countries. Also, check if they provide robust fraud protection features.

Evaluate Security Features

Look for gateways that support PCI DSS compliance, tokenization, and advanced fraud detection tools. These features protect sensitive data and reduce the risk of fraud. Make sure the gateway uses SSL encryption to secure data transmission.

Review Fees and Costs

Compare setup fees, transaction charges, monthly fees, and chargeback fees across providers. Choose a plan that aligns with your sales volume and offers transparent pricing. Remember, the cheapest option may lack necessary security features.

Integrating Your Payment Gateway

Choose Integration Method

Most gateways offer API integration, hosted payment pages, or shopping cart plugins. Select the method that best suits your ecommerce platform and technical skills. Hosted pages are easier to set up but less customizable.

Steps for Seamless Integration

- Register for an account with the chosen payment gateway provider.

- Obtain API keys and credentials for integration.

- Follow the provider’s documentation to embed code into your website.

- Test the integration thoroughly before going live.

Testing Your Payment System

Use sandbox or test mode environments provided by the gateway to simulate transactions. Verify that payment data is encrypted and transmitted correctly. Test various payment methods, error handling, and refund processes to ensure everything functions smoothly.

Ensuring PCI Compliance

What is PCI DSS?

Payment Card Industry Data Security Standard is a set of security standards designed to protect cardholder data. Compliance is mandatory for any business handling credit card information.

Steps to Achieve PCI Compliance

- Use PCI-compliant payment gateways and services

- Ensure your website uses SSL encryption

- Regularly update your website’s security patches

- Limit access to sensitive data within your organization

- Perform regular security audits and vulnerability scans

Implementing Additional Security Measures

Tokenization and Encryption

Tokenization replaces sensitive information with non-sensitive tokens, making stored data useless to hackers. Encryption ensures that data transmitted over the internet remains unreadable by unauthorized parties.

Fraud Detection Tools

Many gateways offer features like AVS (Address Verification Service) and CVV checks. Use these tools to validate transactions and flag suspicious activity. Set up automatic alerts for unusual transaction patterns.

SSL Certificates for Your Website

Secure Socket Layer certificates encrypt data exchanged between your website and users. Display HTTPS in your website URL to reassure customers that their data is protected. Regularly update your SSL certificates to maintain security levels.

Best Practices for Payment Security

- Keep your website software and plugins updated

- Use strong, unique passwords for admin access

- Limit staff access to payment data

- Monitor transactions regularly for fraud signs

- Educate your team about security threats and best practices

Legal and Regulatory Considerations

GDPR and Data Privacy

If you operate in the European Union, comply with GDPR regulations to protect customer data. Obtain explicit consent and provide clear privacy policies.

Local Payment Regulations

Be aware of country-specific laws governing online payments and data protection. Work with local banking partners to ensure compliance and smooth operations.

Choosing the Right Ecommerce Platform for Payment Integration

Most platforms like Shopify, WooCommerce, and Magento offer built-in support for popular payment gateways. Verify compatibility and ease of integration before selecting an ecommerce platform. Use extensions or plugins provided by your platform to simplify setup.

Monitoring and Maintaining Your Payment Gateway

Regularly review transaction logs and security reports to identify potential issues early. Schedule routine security audits and update your software as needed. This proactive approach helps maintain a secure payment environment for your customers.

Setting up a secure payment gateway involves careful planning, choosing reliable providers, and implementing best security practices. Taking these steps ensures your ecommerce store remains trustworthy and protected against threats. With a well-secured payment system, you can focus on growing your business and serving your customers confidently.

How To Add A Payment Gateway To Your Website (QUICK & EASY)

Frequently Asked Questions

What steps should I take to ensure my payment gateway is compliant with security standards?

To keep your payment gateway compliant, you need to adhere to the Payment Card Industry Data Security Standard (PCI DSS). Implement strong encryption protocols, regularly update your software, and restrict access to sensitive information. Conduct routine security audits and train your team on best security practices to maintain compliance and protect customer data.

How can I verify the security of a payment gateway provider before integration?

Check if the provider is PCI DSS compliant and has robust security certifications like SSL/TLS encryption. Review their security policies and customer reviews for insights into their data protection measures. Reach out to their support team to ask about their fraud prevention methods and how they handle security breaches.

What are the best practices for safeguarding customer payment information during transactions?

Use end-to-end encryption to protect data during transmission and ensure your website employs HTTPS. Store only essential payment data and avoid saving sensitive information unless absolutely necessary, using secure, encrypted databases. Implement multi-factor authentication for administrative access and monitor transactions for suspicious activity to prevent fraud.

How can I integrate multiple payment options securely into my ecommerce platform?

Select reputable payment service providers that offer secure API integrations and support various payment methods. Use tokenization to handle sensitive data securely and ensure each integration complies with security standards. Regularly update integrations and conduct security tests to maintain a high level of protection across all payment options.

What measures should I take to monitor and respond to payment security threats post-setup?

Set up real-time monitoring tools to detect unusual transaction patterns and potential breaches. Establish an incident response plan that outlines steps to take in case of a security issue. Keep your software up-to-date with the latest security patches and train your team to recognize and handle security threats promptly.

Final Thoughts

Setting up secure payment gateways for ecommerce involves choosing trusted providers and implementing SSL certificates to protect customer data. Regularly update your software and security protocols to prevent vulnerabilities. Clear communication and transparent policies build customer trust, ensuring smooth transactions. Ultimately, understanding how to set up secure payment gateways for ecommerce helps safeguard your business and customers, fostering confidence and encouraging repeat sales.